- 홈으로가기

- ETF Basics

- How to use ETF

How to use ETF?

-

Core and Satellite strategyThe Core-Satellite strategy is an investment strategy where ETF or the relevant portfolio tracing market indices are positioned at the ‘Core’ whilst the sector ETF is structured according to its proportion to the aggregate value of listed stock or its proportion to the investment is positioned in ‘Satellite’. By this strategy, an investor can trace market indices as well as pursue returns in excess of market returns by adjusting the proportion of the sector outperforming market indexes.The Core-Satellite strategy can be implemented at reasonable expenses by using market index ETF and Sector ETF currently listed at the stock exchange. Many pension funds in the US today have implemented the Core-Satellite strategy by using exchange index ETF and Sector ETF.In addition, the Core-Satellite strategy can bring another effect of alleviating volatility of return of the whole investment portfolio. In other words, portfolios under the Core-Satellite strategy reduce volatility with their diversification effects, providing stable investment performance, while portfolios focusing on certain items or certain industries should have severe volatility resulting from changes in market conditions.

CORE

ETF

Core lnvestment

traclng market lndexesSATELLITE

Sector ETF where proportions of seclor are adjustedAve lnwstmem in

individual shaesStyle individual portfolio -

Plug & Play StrategyThe Plug & Play strategy can be implemented with ETFs. In case where a specific sector or market has a positive prospect while individual items in the sector/market cannot be chosen easily, an investor might need to invest in ETF first, and then invest in under-valued stocks or leading stocks in the sector/market when their performance enhancement is visibleEven if the sector or market moves in a different direction from what the investor had expected, this strategy using ETFs provide more favorable results because due to its diversification investment effect which cannot be attained by investing in individual stocks.

Investing in ETF replication a sector prior to selecting individual stocks

MOVING TO INDIVIDUAL STOCKS

Selected

Individual stockSelected

Individual stockSelected

Individual stockSelected

Individual stockSelected

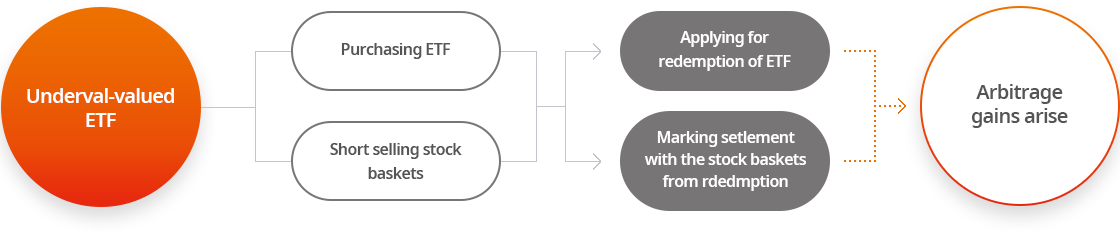

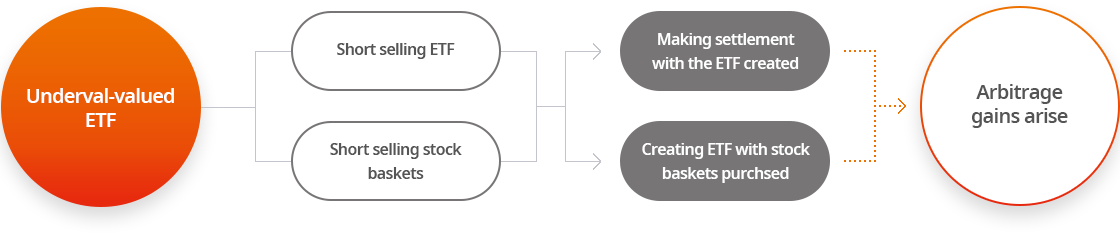

Individual stockTIGER KOSDAQ PremierEven if the sector or market moves in a different way from the investor’s expectation, this strategy using ETF provides more favorable results because of ETF’s own diversification investment effect which cannot be attained by investing in individual stocks.Previously, arbitrage trading had been performed with two asset types, stocks and futures/options. However, adding ETF, an investor is able to adopt more various arbitrage trading strategies with three asset types, that is, ETF, stocks, and futures/options. Especially, with a feature that ETF is created/redeemed with spot (stock baskets), ETF can reinforce the effect of arbitrage trading further.

-

Arbitrage Trading Strategy when ETF is over-valued

-

Cash ManagementInstitutional investors can easily secure liquidity using ETFs which can be purchased/sold at the stock exchange real-time.Cash for purchasing stock portfolid

Stock portfolio / Bonds

Tentativetv investing

in ETFStock portfolio / Bonds

Individual stockStock portfolio / Bonds

-

ALTEMATIVE STRATEGY FOR INVESTMENT IN FUTUREAlternative strategies for investment in futures can be implemented by using ETF which traces market indexes. Can be used as an alternative to those Investors who want to avoid Roll Over-Risk, which is in Futures trading; / Investors who require daily adjustment; / Investors who look for small units of contracts

ALTEMATIVE STRATEGY FOR LIST - Description,Mutual Fund,ETF Description Mutual Fund ETF Maturity Maturity doesn’t exist Maturity exists. Liauidity Abundant liauidity(Liauidity Providers) Primary market and Secondary market Liquidity gets abundant only when maturity is drawing near. Roll over NO Roll Over Roll Over Risk Minimum investment amount Can be implemented with the amount of 1 share. Bigger because determind based upon risk amount. Warrant Money Same as that of general stocks Inital margin, Maintenance margin, and Margin call -

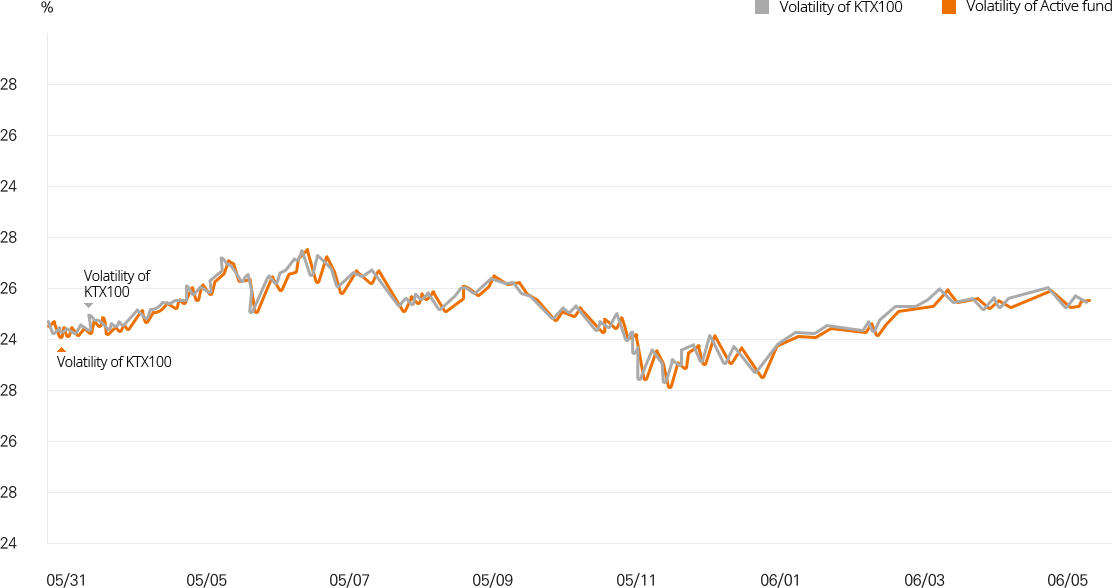

SEPARATE ALPHA AND BETAUnder the Separate Alpha and Beta Strategy, a fund’s position can be divided into market position (KRX100) and Actively managed position. thereby reducing volatility of returns of the fund. This strategy is effective for larger funds. By reducing ‘Active’ position, the strategy can enhance efficiency of selection and concentration

-

Bond ETF AdvantageBond ETFS are Exchange Traded Funds that track bond indexes. Bond ETFs contain bonds with various maturity dates, and are rebalanced periodically to manage a fixed duration. One of the unique characters of Bond ETFs is that investors can expose their portfolio to an OTC product by trading on the exchange.LiquidityUnlike bonds that are traded over the counter, Bond ETFs are listed on the KRX(exchange) and can be traded easily during trading hours. Liquidity is provided through two sources - the primary market(creation/redemption of the fund) and the secondary market(exchange)

- TransparencyUnlike bonds that lack price information, Real Prices of Bond ETFs are updated every 10 seconds. Moreover, historical price data is also available.

- AccessibilityUnlike bonds that are traded in 10bil.KRW unit, Bond ETFs are traded based on a single share unit at an affordable price (TIGER KTB3: index base price:10,000pt, index multiplier:10). Investors can easily expose parts of their portfolios to bonds through Bond ETFs

- Easy to TradeUnlike bonds that are traded over the counter through brokers, Bond ETFs are listed on the KRX, and can be traded just as stocks through brokers, phone orders, or on-line trading systems.

- DiversificationBond ETFs are composed of at least 3 components, and investing in Bond ETFs gives investors immediate exposure to the ETF components.

Bond ETF Features Mixed feature of Stocks, Bonds and FundsBond FeaturesLow Volatility, Unique Behavior : Just like their underlying assets, bond ETFs move in different patterns and directions, and have a lower volatility compared to stocks. These features of Bond ETFs can add stability to investors’ portfolio. Constant Cash Flow(Interest) : Bond ETFs distribute interests of the underlying bonds periodically. The amount and time of distribution is fixed based on the information of the underlying bonds. Investors can plan financial schedules based on these cash flows.Bond Features list - Stock Features, Fund Features Stock Features Fund Features No Maturity : Bond ETFs periodically rebalance its components to manage a fixed duration, and therefore there is no maturity unlike bonds. This feature is more close to stocks. Price Exposure (Possibility of Principal Loss) : Bond ETFs are traded through the exchange, and prices change constantly due to factors such as supply & demand, interest rate, policy, etc. Unlike bond investors who receive par value of the bond at maturity, Bond ETF investors are constantly exposed to price change of the ETF. As there is no maturity, investors are exposed to risk of principal loss when they sell Bond ETFs. Diversification : Bond ETFs are composed of more than 3 components, and the weight of a single component is restricted. Unlike Bonds or Stocks that are single products with simple features and movements, the character of the ETF is a result of the move ments and characters of its underlying assets.